With the passing of their baby boomer parents and elderly loved ones, more Americans are having to deal with estate and trust taxes.

According to Accounting Today, the number of income tax returns for estates and trusts (Form 1041) increased from 2.82 million in 2020 to 3.24 million in 2021, a 14.9% increase. In a similar vein, 644,024 forms (1041-ES) for estimated income tax for estates and trusts were used in 2021, which is an increase of 1.6% over the year before.

As the largest wealth transfer from baby boomers to younger generations continues, tax professionals are observing similar increases this filing season. This wealth transfer is bringing with it more complicated tax questions regarding trust arrangements.

“As baby boomers are well into their golden years, there is an increased desire to help the next generation manage their inheritance, [but also] a fear they will squander their legacy, causing them to create trusts to pass assets efficiently to the next generation, but with some control being exercised from the grave, if you will,” According to Tom O’Saben, enrolled agent and director of tax content and government relations at the National Association of Tax Professionals (NATP), Yahoo Finance. “The number of taxpayers with trusts has increased as a result.”

Greatest Wealth Transfer

Wealth transfers will total $84.4 trillion by 2045, according to data from market intelligence company Cerulli Associates. Of that, $72.6 trillion will be distributed to heirs, and the remaining $11.9 trillion will be given to charitable organizations. Baby boomers will transfer 63% of this wealth—or $53 trillion—to older generations and the Silent Generation, primarily over the course of the next ten years. The Silent Generation and older people will pass on $15.8 trillion.

While it is anticipated that high- and ultra-high-net-worth households will account for 42% of those transfers, the remaining 58% of transfers will take place between less wealthy households, some of which may be turning to professionals for the first time.

“We have seen an increase in the number of trust filers for the past two years due to the passing of a loved one and questions on trust administration issues,” CPA and financial planner at YNCPAs Dwight Nakata spoke to Yahoo Finance.

Many people learn about a trust after a loved one has passed away when they attempt to access money from a bank account or investment account and find that a trust has been designated as the beneficiary through a payable-on-death (POD) or transfer-on-death (TOD) document.

“People don’t talk about it to avoid family in-fighting, so they say, ‘your father and I have taken care of it,’ and put instructions in a trust,” O’Saben said. “It’s the classic Rain Man example to stop a child that’s a spendthrift from using his special needs brother to raid the trust.”

What is a Trust?

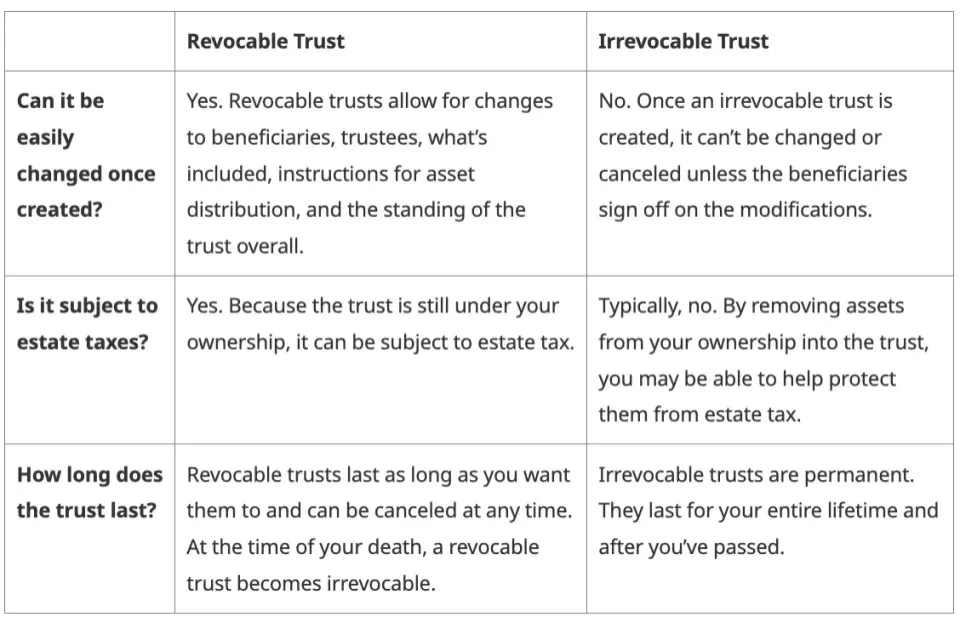

Trusts give the grantor—the person who establishes the trust—the ability to make decisions regarding the distribution of assets outside of probate court while keeping those decisions private. Revocable and irrevocable trusts are the two varieties.

Revocable trusts are created while the grantor is still alive and are amendable. Usually, the grantor also serves as trustee and is in charge of paying taxes. A revocable trust, however, turns into an irrevocable trust upon the death of the grantor.

An irrevocable trust endures after the grantor’s passing and cannot be modified. While still alive, a grantor can appoint an irrevocable trust. If a loved one has passed away, you are dealing with an irrevocable trust, and the successor trustee is accountable for any tax filings depending on the trust’s assets.

Trustee’s Obligation to File Taxes

Despite the fact that a trust may have a taxpayer as a beneficiary, it is the trustee’s responsibility to manage the trust’s business, which includes filing tax returns.

Since the grantor may have changed trustee designations before passing away, it happens frequently that the family member the grantor selects as the trustee is unaware of the choice until after the grantor’s passing. The successor trustee and backup trustee will be named in the trust.

Before taking any action, such as filing taxes, if you have been named the trustee, it is crucial to consult with an attorney and an accountant. The terms of the trust, assets, who receives what, and the obligations and duties of the trustee will all be explained by a lawyer.

“Trustees should consult the attorney that wrote the trust, understanding that a tax professional is not an attorney and can’t interpret the legal underpinnings,” O’Saben said. “then invite the accountant or financial planner who participated in the trust’s planning.”

The accountant will guide you through tax issues such as determining whether the trust needs to file Form 1041 or 1041-ES and obtain a tax identification number (TIN). The nature of the trust’s assets and the rules set forth in the trust document govern a lot of things.

The income tax return for trusts and estates is Form 1041, while Form 1041-ES is a voucher for sending estimated tax payments when a trust has a tax liability.

“Since there is an increase in 1041-ES filings, that means more estimated taxes are being submitted for trusts, meaning more trusts owe tax because they are retaining income rather than distributing it each year to beneficiaries,” O’Saben said.

If you learned last year that you were a trustee or beneficiary of a trust following the passing of a loved one, speak with a lawyer and a tax expert to determine your tax-filing responsibilities.

“Persons thrust into the role of being a trustee are often well outside their comfort level for dealing with these instruments and their responsibilities as a trustee,” O’Saben said. “Most people seek the advice of a tax expert because poor trust management can result in unanticipated tax consequences, displeased beneficiaries, or, in extreme cases, litigation by these same parties against the trust and/or the trustee.”